You started your business a while ago. At first it was tough, but the business has started to take off. You would like to claim back some of the VAT that you pay to your suppliers, but you have to register for VAT to claim back the VAT.

Who can or should register for VAT?

If your business’ taxable supplies (turnover) exceed R1,000,000 in a 12 month period, you are required to register. You can also register voluntarily if your turnover exceeded R50,000, or if you expect that your turnover will exceed R50,000.

What is VAT?

VAT, or Value Added Tax, is an indirect tax that is based on consumption in the economy. According to the VAT 404 Guide from SARS, the main characteristics of VAT are as follows:

- It applies to goods and services

- It is proportional to the price of the goods and services

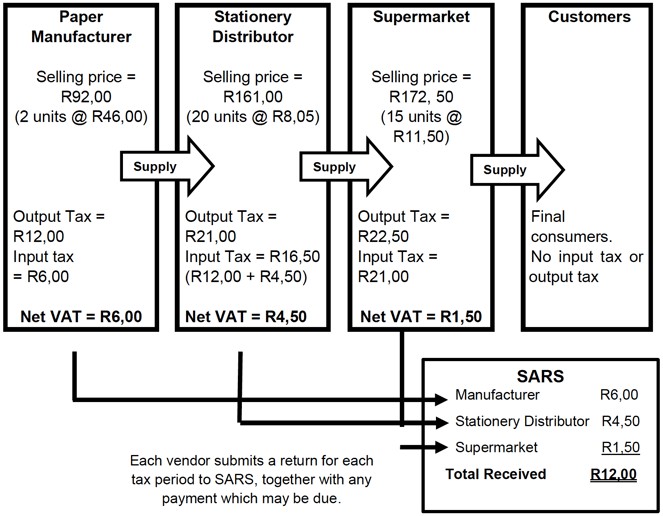

- It is charged at each stage of the production and distribution process

- The person paying the tax to SARS, can deduct the VAT that he/ she paid during the preceding stages on the goods and services.

How does VAT work?

VAT is currently levied at a standard rate of 15% (there are some items that attract VAT at 0% or are exempt from VAT). VAT is paid when you supply goods or services to customers, but you can deduct the VAT that you paid to render the before mentioned services or produce the before mentioned goods.

The example below, which has been taken from the VAT 404 guide, sets out the mechanic quite nicely:

When should you declare and pay / claim VAT

You have to submit your monthly / bi-monthly VAT return (VAT 201) on or before the 25th of the month following your VAT period. If you submit your VAT 201 return via e-Filing, you can submit your return and the payment on the last business day of that month.

Your tax period is dependent on several factors:

- Bi-monthy. This is the standard tax period, and you are required to submit a VAT return every two months. It could be even months (February, April Etc) or uneven months (January, March etc)

- Monthly. If your turnover exceeds or is likely to exceed R30 million in any consecutive period of 12 months, you will have to submit monthly VAT returns.

What happens when I pay or declare after the cut-off date?

If you pay your VAT after the dates mentioned in the paragraph above, SARS will levy a penalty of 10% of the outstanding amount, and will also charge interest at the prescribed rate.

How should I register for VAT?

If you want to register for VAT, you can do it at a SARS branch, virtual meeting or via e-Filing.

You can refer to the VAT Registration Guide on the SARS website for more information on the registration process, and the documents that will be required to register.

Conclusion

Even though there are several benefits to being registered for VAT, like being able to claim back the VAT paid to suppliers, it can lead to a lot of additional administration and there is always the risk of late submission, late payment and VAT audits.

Feel free to contact us if you have any additional queries.

JM Bennett is a Chartered Accountant (SA), a Registered Auditor and a Registered Tax practitioner. He obtained an MBA from Wits Business School in 2020 and a Higher Diploma in Tax from the International Institute of Tax and Finance in 2016. He has almost 20 years of experience in accounting, auditing and tax of SMEs.